STEP 1:

Setting clear goals is the foundation of any successful real estate project, and this first step is the most critical. Whether you are starting by securing land or by defining how much you can realistically invest, your decisions at this stage will shape the entire project. A well-thought-out plan must align closely with your financial capacity, timelines, and long-term objectives. Without this clarity, even well-intentioned projects can quickly become delayed or overextended.

When preparing your budget, it is essential to allow for flexibility. Construction costs in Tanzania can be unpredictable, with building materials often subject to price fluctuations. A practical approach is to include a contingency margin of 10–15% across your estimates to account for inflation, supply changes, and unforeseen expenses. Like any business, real estate carries risk, but these risks can be managed effectively when they are anticipated and properly budgeted for from the beginning.

Once your land position and budget framework are defined—acknowledging that adjustments may occur over time—it is important to remain disciplined and committed to the plan. Frequent changes driven by short-term market movements or external opinions can weaken the overall viability of the project. A clear structure allows you to make informed adjustments without losing control of costs or objectives.

At this stage, consulting with a qualified real estate advisor or an experienced construction company is strongly recommended. Professional input helps validate whether your budget aligns with current market conditions, construction costs, and regulatory requirements. This early guidance can prevent costly mistakes, ensuring your project starts on a solid, realistic foundation.

STEP 2:

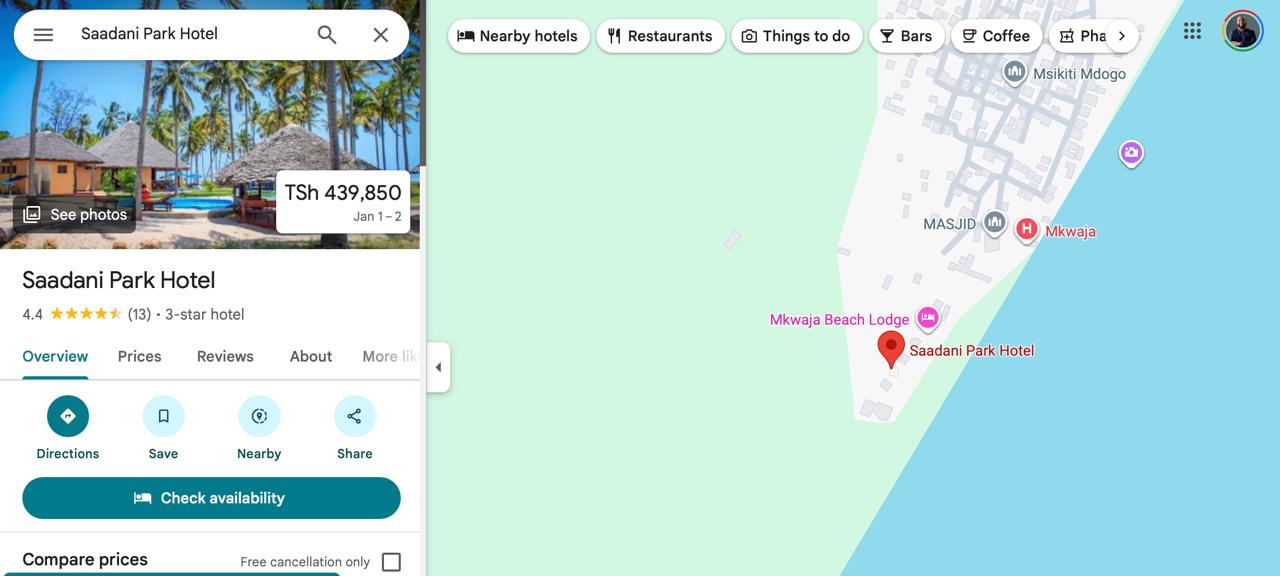

Location is one of the most decisive factors in determining the true value of your real estate investment. A common mistake among inexperienced investors is over-developing a property in an area that cannot support its value. For example, constructing a USD 100,000 home on land worth USD 30,000 or less often results in poor capital appreciation and limited resale potential. The value of a property is not determined by construction cost alone, but by the strength, demand, and growth potential of its location.

Location also directly influences design decisions. Every parcel of land comes with unique characteristics—size, shape, access, zoning, and surrounding developments—which determine what type of structure can be built efficiently and legally. Selecting the right location first ensures that your design complements the land, rather than forcing an expensive or impractical structure onto it.

Before proceeding, thorough due diligence on the property is essential. This includes:

-

Confirming there are no encumbrances, disputes, or bank liens

-

Ensuring the title is clean and legally transferable

-

Verifying property details such as permitted use (Residential/Commercial), land size, shape, boundaries, and coordinates

-

Reviewing the property tax statement to confirm compliance

Only after the location and land documentation are secured should you move into the design stage. This is where you engage a qualified architect and begin translating your vision into a functional and compliant structure. While this stage is creative and exciting, it is also highly technical and can be costly. Architectural drawings must meet strict planning and land ministry guidelines, and poorly prepared submissions may be rejected due to non-compliance or misinterpretation of regulations. Working with experienced professionals at this stage helps ensure approvals are obtained efficiently, saving both time and money.

STEP 3:

Real estate begins with a deliberate decision to start—this is the true take-off stage. After conducting proper research and preparing a realistic business plan, this is where you commit to your goals and move from intention to action. A well-prepared plan clarifies your objectives, timelines, budget, and expected returns, serving as a practical blueprint to guide every stage of the project. Many investors choose to work with a professional real estate agency at this point, as they can prepare a concise, market-aligned business plan that reflects current conditions and investment realities.

This document also becomes a critical tool when engaging external stakeholders. It can be used to support applications for construction or investment financing from reputable lenders, and it provides a clear reference for valuers, bankers, property managers, architects, and legal advisors involved in the process. The feedback you receive at this stage helps validate assumptions, identify risks, and strengthen your structure before capital is fully committed. Because multiple stakeholders are engaged simultaneously, this stage is one of the most important in the real estate journey—strong decisions and firm commitment here set the foundation for long-term success.

COMMON MISTAKES:

10 Common Real Estate Mistakes First-Time Builders and Investors Make

-

Starting without a clear plan or budget

Entering a project without defined goals, timelines, and financial limits often leads to delays, overspending, and unfinished developments. -

Overbuilding relative to the location

Constructing a high-value property in an area that cannot support its price limits appreciation and resale potential. -

Ignoring proper due diligence on land

Failing to verify title ownership, encumbrances, zoning, or tax compliance can result in legal disputes and project stoppages. -

Underestimating construction costs

Not accounting for price fluctuations, inflation, and contingencies—especially in materials—can derail budgets mid-project. -

Choosing design before securing the right location

Designing without understanding land limitations often leads to costly redesigns or rejected approvals. -

Working with unqualified or unverified professionals

Hiring inexperienced architects, contractors, or agents increases the risk of poor workmanship and regulatory non-compliance. -

Changing the plan too frequently

Constant scope changes during construction inflate costs and disrupt timelines. -

Failing to engage professional property management early

Rental performance, maintenance planning, and tenant quality are often overlooked until it’s too late. -

Overleveraging with debt too early

Taking on financing without stable cash flow or realistic projections increases financial pressure and default risk. -

Underestimating the value of legal protection

Weak contracts, unclear ownership structures, or missing agreements expose investors to long-term risk.

Conclusion

Real estate success is rarely accidental—it is built on informed decisions, disciplined planning, and commitment to a clear strategy. By avoiding common mistakes, setting realistic goals, and working with experienced professionals, first-time investors and builders can turn real estate into a powerful long-term wealth-building tool. Whether you are starting with land acquisition, rental income, or a phased construction plan, the key is to begin with clarity and move forward with structure. With the right guidance, strong legal foundations, and professional management, real estate in Tanzania remains one of the most reliable and rewarding investment paths in 2026 and beyond.

Join The Discussion